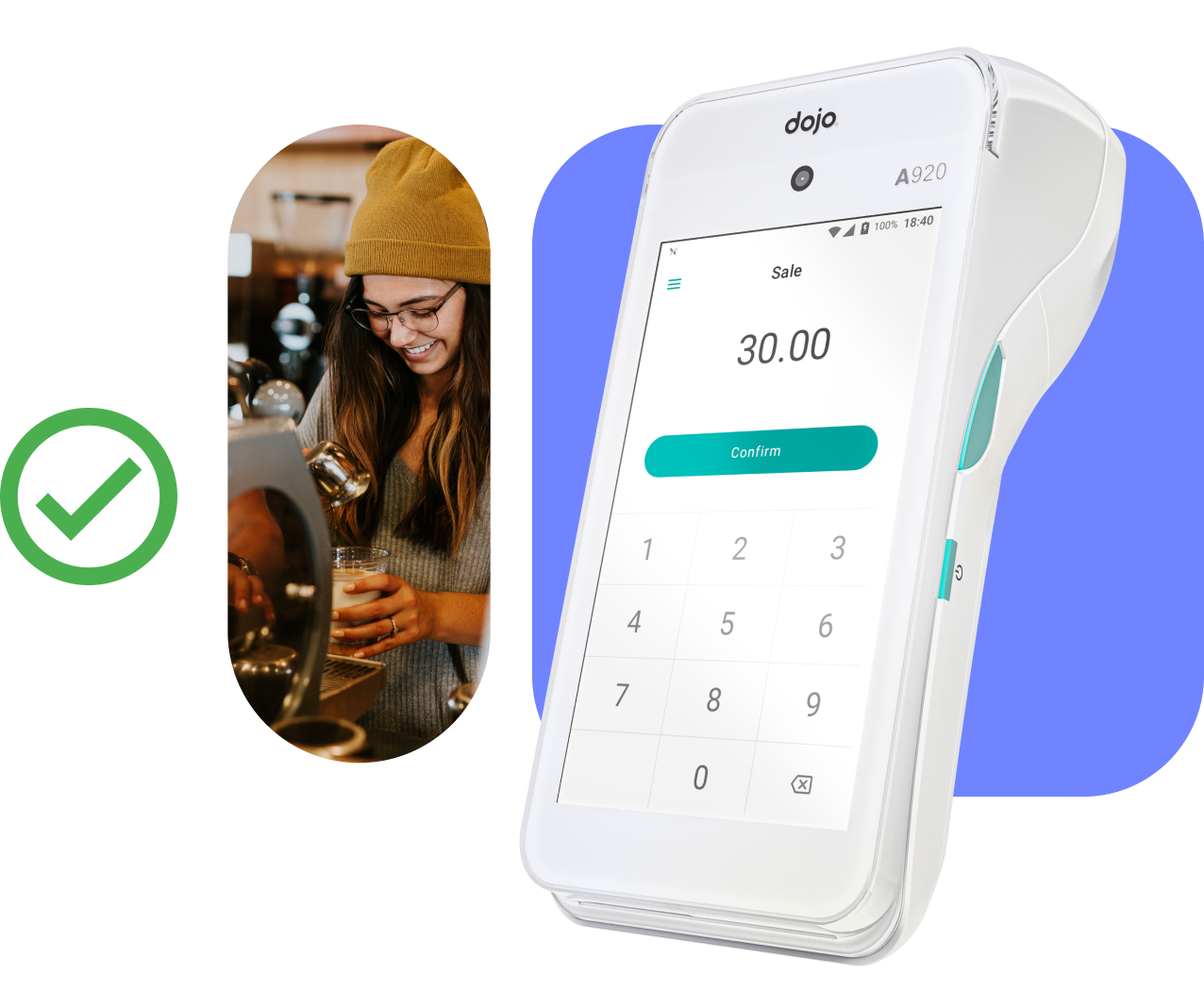

Cut queues with quick payments

Take card payments 50% faster and boost your revenue with the Dojo Go card machine.

Get started

Business insights

See your transactions, simplify PCI compliance reporting and get transfer notifications on the app.

Award-winning customer support

Rely on our stellar phone support and dedicated account management. At Dojo, we answer calls four times faster than competitors.*

*Mystery calls to competitors conducted by Dojo in July 2023.

Smart payment technology

Use your Dojo card machine to split the bill, add gratuity and accept payments with ease.

Powerful payments? Let’s Go.

Thanks to our transaction speeds, the average Dojo business serves up to 48 more customers a day, based on a survey with 700 Dojo businesses in 2022. That’s a lot of orders.

Get started

Built-in 4G

Always accept payments with 4G connectivity. Even if your Wi-Fi goes down, you can still make payments using a mobile signal.

EPOS integration

Fewer errors. Faster transactions. With simple, seamless integration, you’ll be switched over and ready to serve in no time.

10-hour battery life

Serve more customers with 10-hour battery life. Finally say goodbye to endless recharging with your powerful, portable device.

Ready to make the switch?

Make the switch to us and we could pay your current provider’s exit fees up to £3,000.**

Make the switch today**Subject to your annual card turnover. See our Help Centre for more info.

“The Dojo app helps us judge and analyse which periods are busy and which days might be a little quieter.”

FAQs

In an independent research study with Savanta 2023, Dojo could take payments (from key in to authorisation) 58% faster than the market average.