Cashless society report: How many UK cities are becoming cashless?

Whether or not the UK is moving towards becoming a cashless society has been a hot topic for the last decade as the adoption of card payments, contactless payments and other digital ways to purchase have become increasingly prevalent among consumers. Data suggests that 86% of purchases in the UK were made via digitised payments in 2022 (including debit card and E-wallet payments).

As the use of these payment methods has risen, naturally the use of cash has fallen, with cash declining by around 15% each year since 2017. However, we know that not everyone is on board with the shift towards a cashless society. In March 2023, more than 33,000 people in the UK signed a petition stating “Make it illegal for retailers and services to decline cash payments” , highlighting the concern around the direction of payments.

To delve into the topic further, we have analysed our own unique Dojo data to understand which of the UK’s most populated areas are leading the use of contactless payments in this sample, to infer which areas could be moving towards becoming more cashless.

Key findings from the analysis on Dojo’s own anonymised data:

- Bristol leads the way, adopting contactless payments the quickest

- 100% of payments at veterinary surgeries were card payments

- Central London had the highest users of Apple & Google Pay in the UK

- Personal services such as nail salons lagged behind the UK’s adoption of using digitised payment methods

- According to Local Data Company, 1,405 bank branches closed over the last two years

With the use of contactless payments increasing from 65% to 87% in the last three years forecasts expect this figure to continue growing as the adoption of card machines from certain businesses looks to reach 100% across the UK.

After analysing Dojo’s card machine data from 2021 onwards, we have ranked the top 10 cities using cashless payments the most and also look at their increasing rate of adoption with contactless card payment and card payment methods. Using digitised payments over cash is still a relatively new phenomenon for a number of consumers so we also explore what this means for businesses and consumers moving forward.

The top 15 UK locations outside of London for contactless card payments in 2023

| Rank | Area | % of all card transactions that are contactless (July 2021-June 2022) |

% of all card transactions that are contactless (July 2022-June 2023) |

% Difference YoY |

|---|---|---|---|---|

| 1 | Bristol | 93.6% | 95.3% | 1.8% |

| 2 | Leeds | 93.2% | 95.2% | 2.2% |

| 3 | Harrow | 93.6% | 95.2% | 1.7% |

| 4 | Sheffield | 92.9% | 95.1% | 1.5% |

| 5 | Coventry | 93.9% | 95.0% | 2.4% |

| 6 | Leicester | 93.5% | 95.0% | 1.2% |

| 7 | Newcastle | 93.0% | 95.0% | 1.7% |

| 8 | Luton | 93.5% | 95.0% | 1.5% |

| 9 | Romford | 93.6% | 95.0% | 2.1% |

| 10 | Cleveland | 93.0% | 94.9% | 1.6% |

| 11 | Sutton | 93.4% | 94.9% | 1.4% |

| 12 | Halifax | 93.4% | 94.9% | 2.0% |

| 13 | Croydon | 93.4% | 94.9% | 1.6% |

| 14 | Wakefield | 93.8% | 94.9% | 1.6% |

| 15 | Liverpool | 92.1% | 94.9% | 1.6% |

Shoppers in Bristol love the convenience of contactless payments

Out of the sample data, Bristol shoppers are using contactless payments the most in the UK. Between July 2022 to June 2023, 95.3% of all card transactions were contactless, a 1.8% year-on-year increase since 2022. Shopping using contactless payment is a fuss-free and easy way to shop, so it’s unsurprising that the 10th largest city in the UK has avidly adopted this technology.

According to our data, Leeds ranks second for the highest levels of contactless payment adoption in the UK with 95.2% of card transactions being contactless from July 2022-June 2023. The Northern city has seen an even higher year on year (YoY) increase of 2.0%, suggesting that contactless is becoming increasingly popular for shoppers in this area.

The ‘emerging’ cashless locations in the UK

*Ranked by areas that have the highest YoY % difference for using contactless payments. Data source: Dojo’s own anonymised data.

Our data revealed that the use of contactless payments is growing the fastest in Perth out of the cities analysed. The city has seen a 4.9% increase in the adoption of contactless payments in the last 12 months, taking the total to 91.1% of card transactions in the area being contactless.

Stoke on Trent also saw a sharp increase in the percentage of card transactions that are contactless card payments with a 4.8% YoY increase between 2022-2023.

Adoption of Apple and Google Pay across the UK

| Ranked by Highest % | Area | % of transactions above contactless limit (£100) made by Apple/ Google Pay (July 21-June 22) |

% of transactions above contactless limit (£100) made by Apple/ Google Pay (July 22 - June 23) |

% Difference YoY |

|---|---|---|---|---|

| 1 | West London | 21.3% | 28.9% | 36% |

| 2 | North West London | 21.0% | 28.4% | 35% |

| 3 | South West London | 18.7% | 27.4% | 46% |

| 4 | North London | 18.6% | 27.1% | 46% |

| 5 | South East London | 19.3% | 25.7% | 33% |

| 6 | Leeds | 14.1% | 22.0% | 56% |

| 7 | Manchester | 15.1% | 21.7% | 43% |

| 8 | Kingston | 14.8% | 21.5% | 45% |

| 9 | Twickenham | 14.6% | 21.2% | 45% |

| 10 | East London | 15.5% | 21.2% | 37% |

*Ranked by areas of the UK with the highest % adoption of Apple and Google Pay above the contactless card limit (£100). Data source: Dojo’s own anonymised data.

As all TFL (Transport for London) services can be paid for using Apple or Google Pay, it comes as no surprise that London leads the way with the highest adoption of contactless transactions using this technology.

Outside of London, Leeds takes the crown for the highest adoption of Google and Apple Pay. The city has seen a significant increase in uptake over the last 12 months (56%), suggesting that consumers in the area are enjoying the convenience of paying with a device.

The UK areas that have seen the highest adoption of Apple and Google payments in the last 12 months

*Ranked by areas of the UK with the highest % increase of adoption of Apple and Google Pay above the contactless card limit (£100). Data source: Dojo’s own anonymised data.

Other areas across the UK are also starting to catch up with the adoption of Apple and Google payments, as the South East, Midlands and Wales become emerging cities for using this method of payment.

Dartford has shown an impressive 58.5% increase in contactless payments using Apple or Google Pay from 2022 to 2023, showing the sharpest increase in adoption of this contactless payment out of all the cities in the UK. This is somewhat unsurprising given that the largest shopping centre in the UK, Bluewater, resides here. It’s also a tourist hotspot with various National Cycling Routes, regular farmers markets and close transport links to London so it makes sense that the ease and convenience of cashless technology has been increasingly adopted here.

These areas of the UK where businesses accept card payments the most, according to Dojo data

| Rank | City | % of businesses that accept card payments in each area (2022 to 2023) | % difference YoY |

|---|---|---|---|

| 1 | Aberdeen | 96.2% | 21.9% |

| 2 | Plymouth | 95.5% | 0.6% |

| 3 | Kirkcaldy | 94.2% | 7.1% |

| 4 | Worcester | 93.9% | 9.4% |

| 5 | Bath | 93.8% | 4.7% |

| 6 | Brighton | 93.7% | 2.6% |

| 7 | Kilmarnock | 93.6% | 2.9% |

| 8 | Nottingham | 93.5% | 30.7% |

| 9 | Dundee | 93.4% | 0.7% |

| 10 | Exeter | 93.1% | -0.8% |

*Ranked by % of businesses in each UK area accepting card payments. Data source: Dojo’s own anonymised data.

Based on Dojo’s data sample, Aberdeen in Scotland currently leads the way with the highest proportion of businesses that accept card payments, with a 21.8% increase YoY. Not only is Aberdeen the third largest city in Scotland but it’s also a bustling student city so it’s unsurprising that cashless payments are being adopted by businesses.

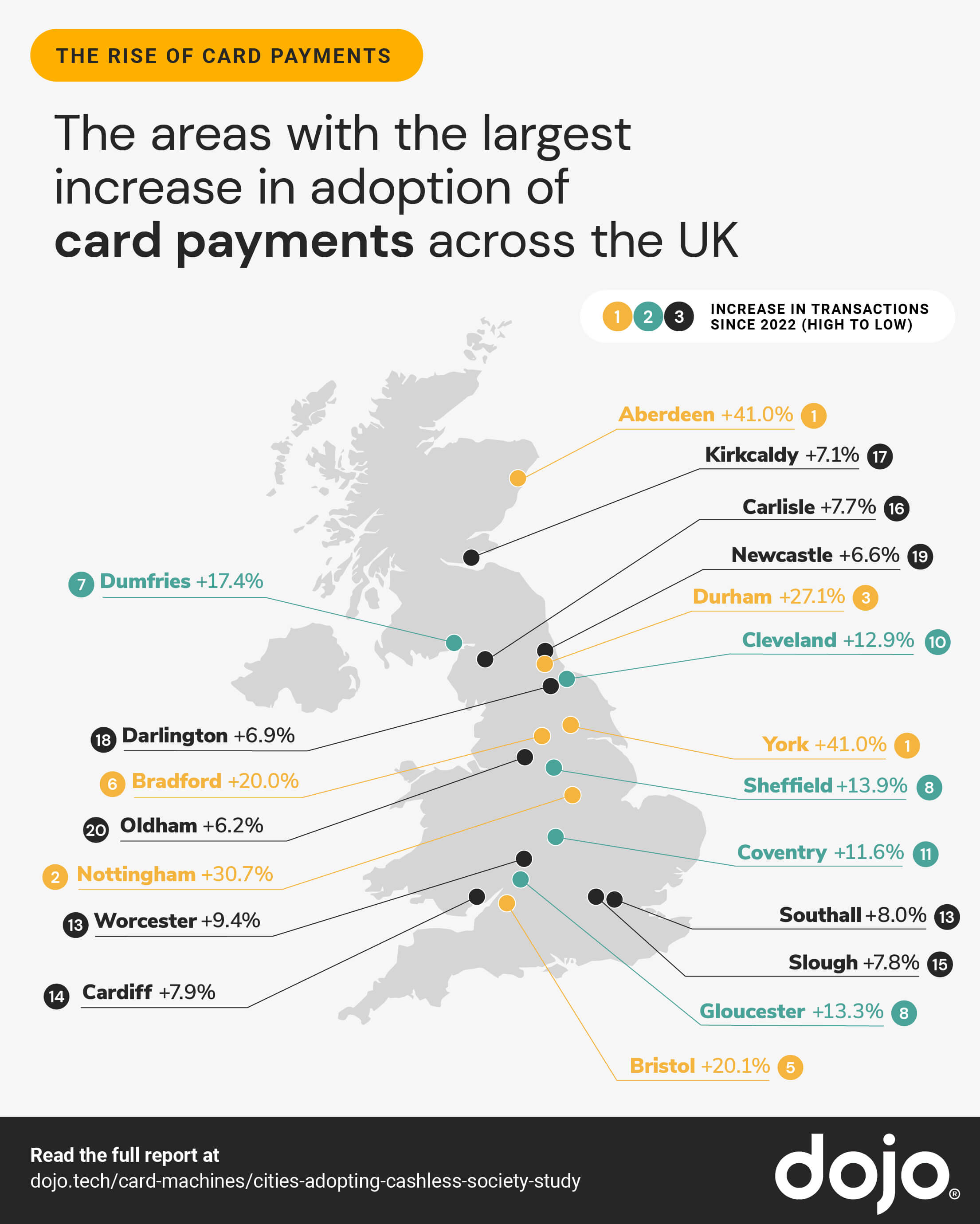

But which UK cities have seen the highest increase in adoption in the last year?

Data source: Dojo’s own anonymised data.

The data has identified York as the city where businesses have seen the highest adoption rate of accepting card payments in the last two years. Between July 2021 and June 2022, just 61.5% of businesses accepted card payments. In the last year, however, this has increased to 86.3%. This 41% increase suggests that this area is on its way to becoming a cashless society.

Nottingham businesses have adopted card payments at a slightly lower rate than York in the last two years at 30.7%. However, this is somewhat unsurprising given that more businesses accept card payments to start with (71.5%). Now, 93.5% of businesses in Nottingham offer digital payments to their customers, suggesting that this is a favourable payment method for consumers in the area.

Which industries accept cards the most?

| Ranked by Highest % | Industry | % of businesses accepting card payments (July 21-June 22) |

% of businesses accepting card payments (July 22 - June 23) |

% Difference YoY |

|---|---|---|---|---|

| 1 | Veterinary Surgeons & Practitioners | 100.0% | 100.0% | 0.0% |

| 2 | Watches | 92.9% | 100.0% | 7.7% |

| 3 | Stationers | 98.8% | 100.0% | 1.3% |

| 4 | Lingerie & Hosiery | 98.6% | 100.0% | 1.4% |

| 5 | Bride & Groom Shops | 91.5% | 100.0% | 9.2% |

| 6 | Camping Goods & Outdoor Wear | 98.6% | 100.0% | 1.4% |

| 7 | Wines, Spirits & Beers | 98.7% | 99.8% | 1.1% |

| 8 | Clothes - Men | 98.6% | 99.3% | 0.7% |

| 9 | Sports Goods Shops | 99.6% | 99.2% | -0.4% |

| 10 | Chemists / Toiletries | 99.7% | 99.1% | -0.6% |

*Ranked by % of businesses that accept card payments by industry. Data source: Dojo’s own anonymised data.

According to Dojo’s data, veterinary practitioners are leading the way with card payment acceptance, with 100% of payments being made on card since July 2021. Arguably, this is due to veterinary payments often being of high value, so card payments are necessary.

Interestingly, the industries adopting card payments the fastest are those with higher-valued offerings, such as the watch industry. Watches often come with a higher price point, and with consumers being more reluctant to carry large amounts of cash, card payments will naturally be the most common payment method.

Industries that are behind on the acceptance of card payments

| Ranked by Lowest % | Industry | % of businesses accepting card payments (July 21-June 22) |

% of businesses accepting card payments (July 22 - June 23) |

% Difference YoY |

|---|---|---|---|---|

| 1 | Car Wash & Valet Services | 14.4% | 18.1% | 25.9% |

| 2 | Nail Salons | 24.8% | 21.9% | -11.6% |

| 3 | Amusement Parks & Arcades | 33.5% | 25.3% | -24.6% |

| 4 | Laundries & Launderettes | 20.1% | 26.6% | 32.7% |

| 5 | Barbers | 35.1% | 42.8% | 21.9% |

| 6 | Tattooing & Piercing | 45.4% | 45.1% | -0.7% |

| 7 | Taxis & Private Hire | 42.4% | 47.8% | 12.6% |

| 8 | Tourist Attractions | 52.8% | 48.1% | -9.0% |

| 9 | Clothing Repairs & Alterations | 53.8% | 57.3% | 6.4% |

| 10 | Chinese Fast Food Takeaway | 49.4% | 59.2% | 19.7% |

*Ranked by % of businesses that accept card payments the least by industry. Data source: Dojo’s own anonymised data.

The data shows that personal services such as nail salons, car washes, and taxi services are among the more reluctant industries to become cashless. From July 2021 to June 2022, only 14.4% of payments were taken through card machines for car wash or valeting services.

Nail salons have shown a vast decrease in contactless payments from 2021 to 2023. From July 2021- June 2022 24.8% of payments in Nail Salons were made by card, but from July 2022- June 2023 the amount of card purchases dipped to 21.9%. Due to these industries being classified as small businesses, many salon owners may be trying to avoid potentially increasing bank charges for accepting cards and instead push for cash purchases.

Biggest increase in card payment adoption

| Biggest % increasers | Industry |

% of businesses accepting card payments (July 21-June 22) |

% of businesses accepting card payments (July 22 - June 23) |

% Difference YoY |

|---|---|---|---|---|

| 1 | Second-hand Shops | 41.9% | 66.5% | 58.5% |

| 2 | Laundries & Launderettes | 20.1% | 26.6% | 32.7% |

| 3 | Car Wash & Valet Services | 14.4% | 18.1% | 25.9% |

| 4 | Kitchen Planners | 68.7% | 84.3% | 22.8% |

| 5 | Fast Food Delivery | 57.9% | 70.7% | 22.1% |

| 6 | Barbers | 35.1% | 42.8% | 21.9% |

| 7 | Chinese Fast Food Takeaway | 49.4% | 59.2% | 19.7% |

| 8 | Tailors | 65.1% | 76.1% | 16.9% |

| 9 | Bureau de Change | 80.5% | 93.1% | 15.6% |

| 10 | Halal Butchers | 84.1% | 95.3% | 13.3% |

*Ranked by % of industries that have seen the highest increase in accepting card payments . Data source: Dojo’s own anonymised data.

Second-hand shops currently show the biggest increase in adopting card payments. With more consumers endorsing second-hand shopping, and the UK clothes resale market expected to rise by 67.5% from 2022 to 2026, this data is somewhat unsurprising.

It’s likely that this industry has had to accommodate increased volumes of business. With card payments being fast, secure and efficient, they are definitely the best option for emerging industries like this.

Fast food delivery has also seen a huge increase of 22.1% YoY. With the online food ordering industry market valued at £3.1bn in the UK, this is not surprising. Fast food companies are having to adapt to satisfy the demands of the new consumer, and with convenience a high priority for food purchases, payment options must meet this criterion also.

The impact of a cashless society on the elderly population in the UK

Back in 2020, an FCA survey concluded that 2.2 million people aged 65+ in the UK would not be able to cope with a cashless society so it poses a question for businesses operating in areas with a higher proportion of this age group: Are they making themselves accessible to all generations?

Although it’s important to note that age does not necessarily equate to digital savviness, reviewing cash accessibility via ATMs and the rate of card acceptance by businesses can give us an insight into which areas could be more negatively impacted if the UK were to become a cashless society.

The areas of the UK that should continue offering cash payments

| Rank | City | Population over 65 according to ONS (%) | Protected ATMS | % of businesses that accepted card per area (July 22 - June 23) | % Difference YoY |

|---|---|---|---|---|---|

| 1 | Dorchester | 29.58% | 5 | 91.8% | -3.6% |

| 2 | Exeter | 25.80% | 13 | 93.1% | -0.8% |

| 3 | Torquay | 25.80% | 2 | 90.1% | -2.4% |

| 4 | Truro | 25.27% | 6 | 91.7% | 4.2% |

| 5 | Taunton | 24.83% | 9 | 92.6% | 1.3% |

*Ranked by % of the population over 65. Data source: ONS & Dojo’s own anonymised data.

According to our research, Dorchester has the highest population of older residents (29.58%), however, an overwhelming 91.80% of businesses accepted card payments. Interestingly, there was a decrease YoY of 3.60%, suggesting businesses are still keen to use cash.

Truro also has a high older population (25.27%). Interestingly, the area’s card acceptance has increased the most out of the top 5 displayed above (4.20%), suggesting that residents in the area are keen to adopt card payment methods. There are also only 6 protected ATMs in the area meaning access to cash could be more difficult here.

Access to cash is also dwindling

Jon Knott, Head of Customer Insight from Dojo, comments,

“Our society is slowly making it harder to access cash. According to LINK, the total number of ATMs in the UK has fallen by 6% from 2021- 2022, and we have seen a huge decline in banks on our high street in the last two years with 1,405 reportedly closing.

Whilst there are still processes in place to maintain cash flow in the UK - such as protected ATMs - the clear increase of uptake in digital payments, and reduction of banks and non-protected ATMs poses some threat to those who have gone their whole life using cash payments.

The digitisation of payments is a natural shift for both businesses and consumers but with a proportion of the UK struggling to adopt digital payment methods at the same rate, there is a clear need for better education about digital financial transactions to make sure that everyone feels confident in handling their money online.”

As the UK moves closer to becoming cashless, it’s important that both business and consumers feel secure using card payment methods, contactless and digital payment technology. So when choosing a card machine like the Dojo Go you can rest assured, as both a business owner and customer, that payments will be fast, secure and efficient.

Methodology

To understand which areas adopted and used contactless payment methods the most, Dojo analysed anonymised card transaction data from their customer base. The number of contactless transactions, transactions via card payment, as well as Apple/Google/Samsung pay transactions, from across the UK was analysed in order to discover how they have increased between 2022 and 2023. Note, all Apple, Google and Samsung Pay contactless data in this report refers to contactless payments over £100 only.

Data around the impact of a cashless society on the elderly is from the below sources:

References

1 % of payments that were made via cash vs card between 2017-2022 (Statista)

2 Petition signatures to make it illegal for retailers to decline cash payments (UK Parliament)

3 Contactless payments increasing 65% to 87% (LLoyds Bank)

4 UK resale market growing by 149% (GlobalData)

5 UK online food ordering industry valued at £3.1bn (Ibis)

6 2.2 million people aged 65+ in the UK would not be able to cope with a cashless society (FCA)

7 The total number of ATMs that have closed down in the UK (Link)

8 The number of banks that have disappears from the UK high street (Local Data Company)