The SME insights report: How UK businesses are managing their finances

Managing finances effectively is crucial for the success and sustainability of any business, and this has only become more challenging since the pandemic. In fact, three in five British business owners found 2023 one of their most challenging years, citing the cost-of-living and energy crises as key factors [1].

Although many businesses are still facing challenges as a result of the economic climate, proper financial management can help ensure businesses operate more effectively. Tactical financial management can also enable businesses, especially those who are SME or independent, to allocate resources more strategically, invest in growth opportunities, and expand their operations.

Financial management can often contain a lot of jargon and requires a lot of time and resources, whilst many business owners are time-poor. Refining technology can be a good place for businesses to start. For example, taking measures such as implementing reliable and secure card machines can make taking payments more efficient and less time-consuming, which in turn can help with consolidation and support monitoring finances.

To understand where business owners feel like they need more support, Dojo surveyed 1,001 SME owners and decision makers in the UK (including micro-business owners) to understand how comfortable they are with financial literacy, and to better understand how business owners understand and manage their finances in 2024.

Here’s a summary of the report’s findings:

- 30% of businesses' biggest challenge is financial stress

- 1 in 5 businesses don’t have an emergency buffer

- 3 in 10 businesses have made redundancies in 2024

- 27% of businesses have borrowed money from friends to support their business

- The most common length of cash runway for businesses is six months on average

- 78% of businesses are expecting profitability and revenue growth in 2024

- 1 in 2 businesses have overdue and late payments owed to them

Founders biggest challenges in 2024

Financial stress and technological acceleration are the biggest challenges in 2024

With higher interest rates and rising inflation in the UK, business owners stated that their biggest challenge for this year is financial stress.

Despite quoting financial stress as their biggest challenge, 78% of business owners do anticipate growth and profitability in 2024.

Their second biggest challenge (27%) in 2024 is technological acceleration. Business owners shared that they were worried about the cost of investing in technology and upskilling their workforce in digital skills.

| Biggest challenges | Percentage of businesses |

|---|---|

| Financial stress (e.g. inflation, high interest rates, and access to credit, pricing, investment in technology) | 30% |

| Technological acceleration (e.g. the cost of investing in tech, upskilling your workforce in digital skills, using technology for business efficiency) | 27% |

| Sales | 22% |

| Keeping up with customers (e.g. marketing, demand, changing expectations) | 21% |

| Hiring | 21% |

| Staff retention | 21% |

| Creating repeatable and scalable processes | 20% |

| Time away from family and friends | 20% |

| Deadlines | 20% |

| Late payments from customers/clients | 19% |

| Burnout | 18% |

| Mental Health | 17% |

Hiring and staff retention are some of the founder's challenges in 2024

Hiring and staff retention were some of the biggest challenges for business owners, at 21%. With the job market getting tougher and companies experiencing budget constraints, hiring and retaining staff is becoming increasingly difficult.

The industries with the least cash runway

Cash runway, the length of time a business can sustain its operations with its current cash reserves, can vary significantly across different industries due to several factors such as seasonality, revenue generation cycles and the competitive landscape.

The survey found that, on average, businesses have six months of cash runway. The data also found that most businesses (30%) have 5-6 months of cash runway, whilst only 6% have 12 months. The industry with the lowest cash runway was manufacturing and utilities, which had less than six months.

The manufacturing and utilities industry had the lowest cash runway

The manufacturing and utilities sector often requires significant upfront investment in machinery, equipment, and infrastructure. This can tie up a large portion of available cash, leaving less for operational expenses and emergencies. These industries can also be highly cyclical, with fluctuating demand based on economic conditions.

Manufacturing and utility industries also often have high operational costs, with raw materials, labour, energy, and maintenance. If these costs increase unexpectedly or efficiency decreases, it can pressure cash reserves, resulting in a smaller cash runway.

Finally, manufacturing often involves long sales cycles, with payments sometimes received well after delivering products. This delay in revenue can strain cash flow, especially if there are delays in production or delivery.

Seasonality affecting cash runways

Our data found that education businesses have an average of six months of cash runway. Many educational institutions, such as universities and schools, operate on a seasonal basis, with significant expenses incurred at the beginning of each academic year. Revenue generation may decrease during school holidays while fixed costs remain constant, impacting cash flow.

The travel and transport industry is similarly seasonal, with an average cash runway of six months. During off-peak seasons or periods of reduced travel activity, cash flow may decline while fixed costs, such as payroll and maintenance expenses, remain constant.

External factors also heavily influence the travel industry; these unpredictable events can lead to sudden declines in bookings and revenue, affecting cash flow and eating away at the cash runway.

Nearly 20% of businesses do not have an emergency fund in place

Out of the 1,001 businesses surveyed, 79% reported having an emergency buffer to fall back on if their business struggles. However, nearly 1 in 5 businesses answered no to having an emergency buffer, and 2% answered that they weren't sure if they had one.

Business owners who own legal companies had the highest percentage of not having an emergency buffer at 26%, whereas Travel and Transport had the most at 86%.

An emergency fund is a reserve of cash set aside to cover unexpected expenses or financial emergencies. It's important to have an emergency fund to help cover the costs of challenging times, such as a cost-of-living crisis or an increase in prices.

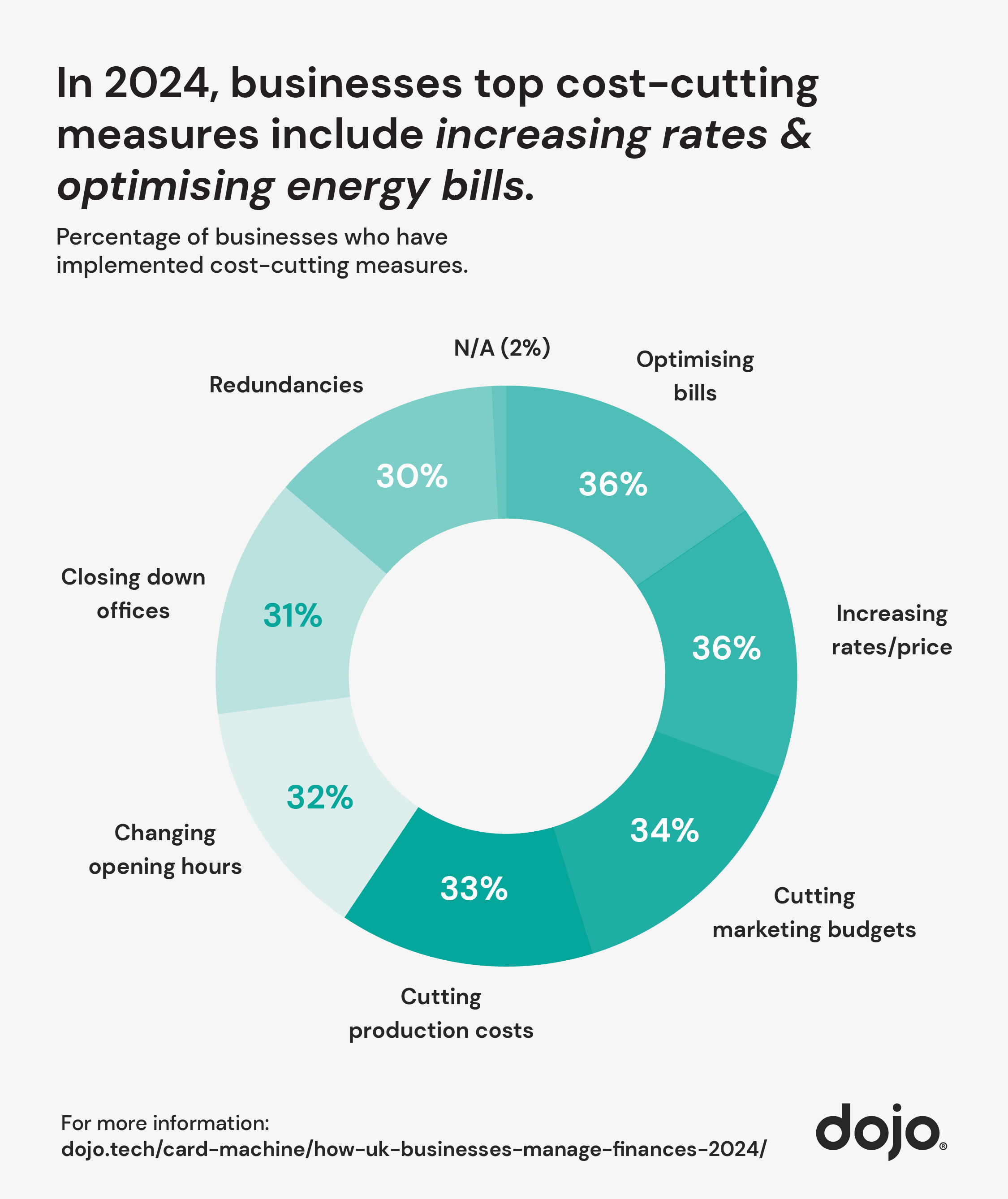

The top cost-cutting measures businesses have implemented in 2024

As labour, services, and material costs rise, many businesses seek ways to reduce expenses in 2024. Here’s a breakdown of the most common ways businesses cut costs and the sectors that used each measure most:

1. Optimising bills - 36%

Small, simple actions like using energy-efficient appliances and turning off lights when not in use can help businesses reduce their utility bills. Negotiating better rates with utility providers or switching to more cost-effective suppliers can also lower expenses. The Arts & Culture sector utilised this method most, with 45% of businesses in this industry saying they had optimised bills to save money.

~1. Increasing rates/prices - 36%

While increasing rates or prices may seem risky, it can be an effective strategy for boosting revenue and covering increasing costs. However, this approach must be carefully balanced to avoid driving away customers or clients.

2. Cutting marketing budgets - 34%

Businesses can reduce expenses by focusing on cost-effective marketing channels. Analysing marketing initiatives' return on investment (ROI) can also help identify areas where spending can be optimised.

3. Cutting production costs - 33%

Streamlining production processes and negotiating better prices with suppliers can help reduce production costs.

4. Changing opening hours - 32%

Adjusting opening hours based on customer demand can help businesses save on operating costs. For example, if foot traffic is low during certain times of the day or week, businesses may decide to close earlier, open later, or only operate on certain days to minimise overhead expenses.

5. Closing down offices - 31%

Consolidating office space or closing down underutilised offices can lead to significant cost savings on rent, utilities, and other overhead expenses. However, businesses must carefully weigh up the potential impact before making such decisions.

6. Redundancies - 30%

While reducing the workforce through redundancies can result in immediate cost savings, it can also have long-term consequences. Businesses should carefully evaluate alternatives before resorting to redundancies. Our data found that the sales, media and marketing industries implemented the most redundancies at nearly 37%.

7. Only 2% haven't implemented or considered implementing any cost-cutting measures.

Businesses should prioritise cost-cutting measures that align with their strategic goals and long-term sustainability.

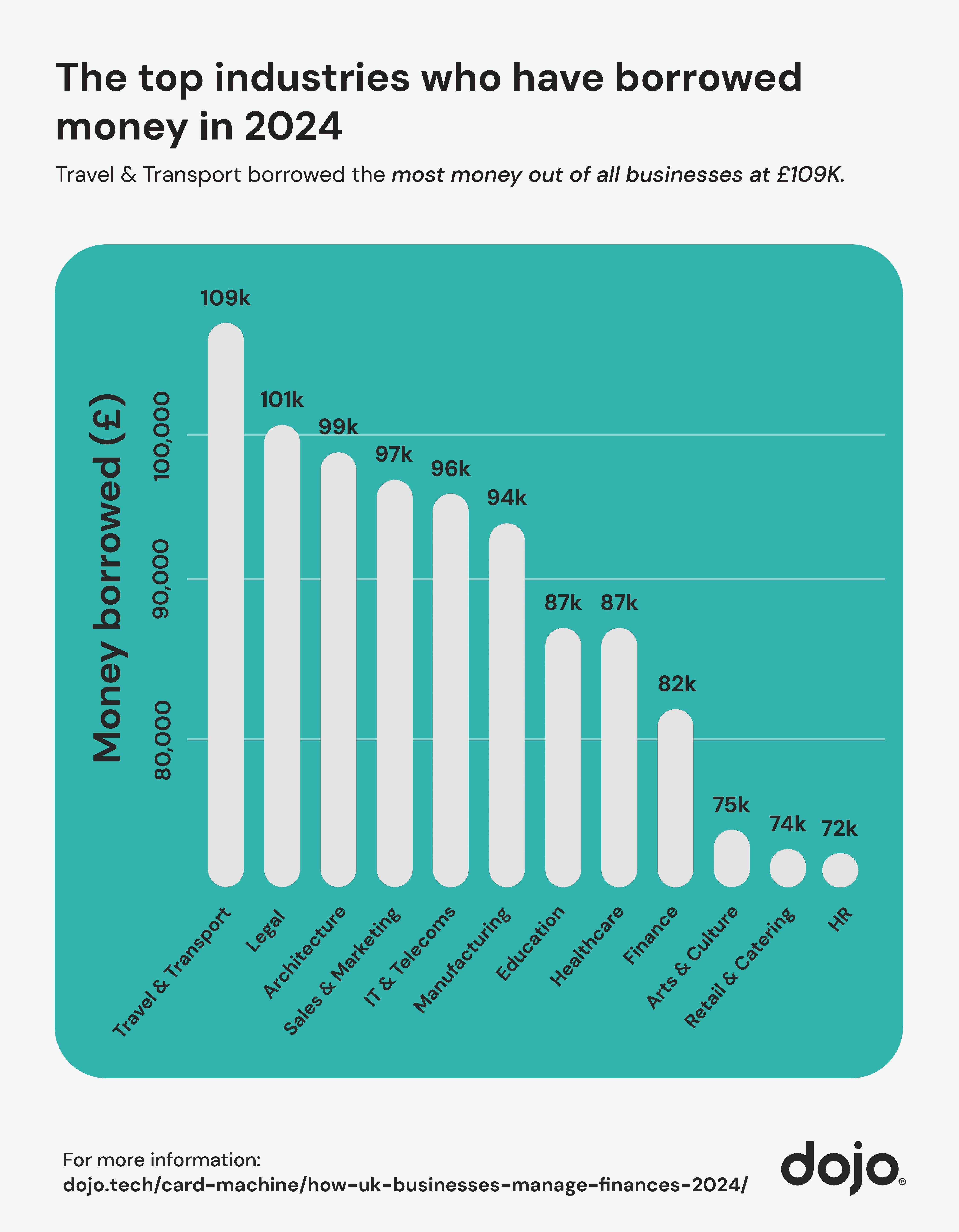

The top industries that borrowed money in 2024

Companies may experience temporary cash flow challenges due to seasonality, delayed customer payments, or unexpected expenses. Borrowing money from banks, government loans or business funding, can help bridge the gap between incoming revenue and outgoing expenses, ensuring smooth operations during cash flow fluctuations.

Businesses often require additional capital to fund expansion initiatives, such as opening new locations, launching new product lines, or entering new markets. Even profitable businesses may encounter situations where they need to borrow money to maintain day-to-day operations. This could occur during periods of rapid growth or when faced with unexpected challenges such as supply chain disruption.

Travel & transport and legal industries borrowed over £100k

Our study found that the travel & transport and legal sectors reported that they borrowed the most at over £100k. Borrowing money is not always a sign of financial distress; it can be a strategic decision to support growth, manage cash flow, invest in opportunities, or navigate challenges effectively.

However, businesses should carefully evaluate the costs and risks associated with borrowing and ensure that they have a clear plan for repayment to avoid excessive debt.

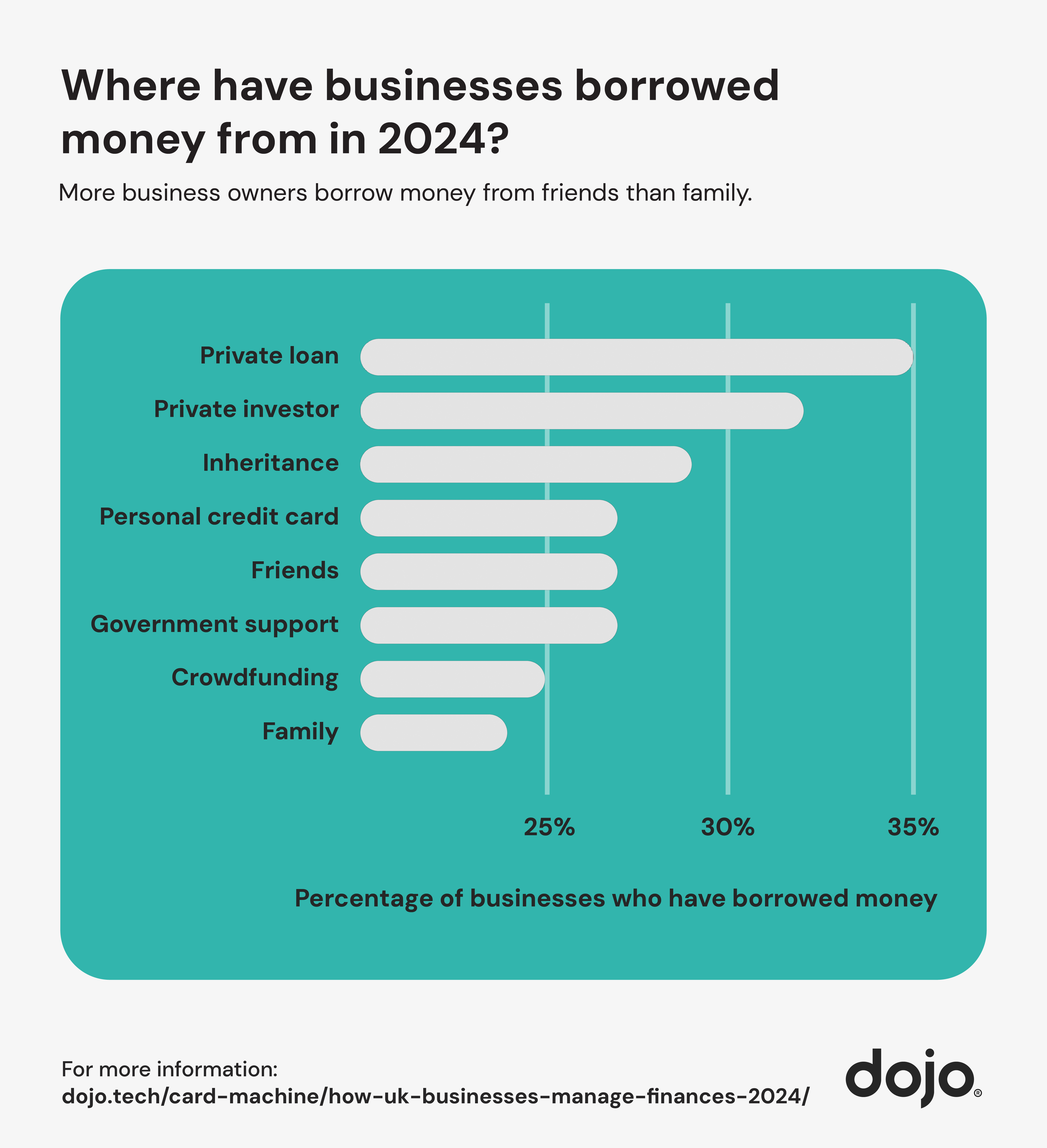

Where do businesses borrow money from?

Private loan - 35%

Borrowing from private lenders involves obtaining funds directly from individuals or small lending institutions. Private loans are loans made outside the traditional bank and may be more lenient regarding repayment terms and eligibility criteria.

Private loans are useful for those who do not qualify for a bank loan. However, it is key to note that private loans typically have a higher interest rate to counteract the higher risk the lender takes. Be sure to use the Financial Conduct Authority’s company checking tool to ensure your chosen loan provider is credible.

Private investor - 32%

Private investors, such as angel investors or venture capitalists, provide capital in exchange for equity ownership or a stake in the company. Private investors often bring valuable expertise, connections, and mentorship to the business. They may be more willing to take risks on early-stage ventures and provide larger funding than other sources.

However, giving up equity often means relinquishing some control and potential future profits. Negotiating terms with investors can be complex, and there's a risk of conflicts of interest or disagreements. Our data found that the finance sector turned to private investors the most, with 39% reporting that they had used private investing.

Personal credit card - 27%

Using a personal credit card for business expenses is a common form of short-term financing. Personal credit cards provide quick access to funds and may offer rewards or cashback incentives. They can be convenient for small or urgent expenses.

However, high interest rates on credit card balances can lead to costly debt accumulation if not paid off promptly. Mixing personal and business finances can complicate accounting and tax reporting, and exceeding credit limits can damage personal credit scores.

Crowdfunding - 25%

Crowdfunding platforms, like Kickstarter, allow businesses to raise funds from many individual investors or backers, typically through online campaigns. Crowdfunding offers access to diverse investors and can generate publicity and market validation for the business idea. It may be easier to secure funding than traditional methods, and giving up equity is often not required.

However, running a successful crowdfunding campaign requires significant time, effort, and marketing expertise. Not all campaigns reach funding goals, and platforms may charge fees or impose withdrawal restrictions.

Friends (27%) and Family (25%)

Loans from friends or family may come with flexible repayment terms, lower interest rates, or no interest at all.

However, mixing personal and business relationships can strain dynamics if repayment obligations are not met. In case of default, there's a risk of damaging personal relationships, and terms may be informal, leading to misunderstandings or disputes.

Our study revealed that people are more likely to borrow money from their friends (27%) than their family (25%), indicating a reliance on peer networks for financial support. Business owners leaning on friends more than family could be due to a reduced stigma and people feeling resistant to putting a strain on their relatives.

Government support - 27%

Governments, including local councils, offer grants, loan schemes, or financial incentives to support business growth and development. However, eligibility criteria for government support programs can be strict, and application processes may be lengthy and competitive. Funds may be limited, and there could be restrictions on how the money is used. Look at the business grants currently offered by the government to see if your business is eligible.

Each borrowing option has advantages and drawbacks, and suitability depends on factors such as the business's growth stage, financial needs, risk tolerance, and relationship dynamics. It's essential for business owners to carefully evaluate their options, seek professional advice if necessary, and consider the long-term implications before choosing a financing source.

49% of business owners are owed late payments

Our survey also found that many businesses suffer from late payments, with 62% of legal business owners and 54% of sales, media and marketing business owners owed late payments. On average, late payments to businesses are over one month late. This is bad for businesses as timely payments are essential for maintaining cash flow, and late payments create an extra administrative burden and operational challenges.

We also found that the retail, catering and leisure industries had late payments due over two months, which can heavily impact a business's financial and operational challenges, particularly small businesses, due to their limited resources.

Business financial jargon

| Jargon | % of businesses unconfident in understanding |

|---|---|

| Burn rate | 11% |

| Aged debtors and aged creditors | 10% |

| Audits | 10% |

| Cash runway | 9% |

| Tax return | 9% |

| EBITDA (Earnings before interest and taxes, depreciation and amortisation) | 9% |

11% of business owners don't understand burn rate

Burn rate is how quickly a company spends its cash reserves to cover the business's costs. To calculate the monthly burn rate, use this simple calculation:

starting cash - (ending cash/number of months)

Legal business owners reported feeling the most unconfident about the term ‘burn rate’, at 17%.

10% of business owners aren't confident in understanding ‘aged debtors and creditors’

Aged debtors refers to the outstanding amounts owed to a business by its customers (debtors) for goods or services provided on credit, whilst aged creditors are the outstanding amounts a business owes to its suppliers. However, we discovered that 10% of business owners lack confidence in understanding these terms.

16% of travel and transport businesses reported that they weren’t confident in understanding aged debtors and creditors - the highest out of all businesses surveyed. Other financial jargon and terms that business owners were least confident in were audits (10%) and cash runway (9%).

How Dojo can help your business

Dojo can make managing your business finances a little easier by ensuring you get paid the next day. With a Dojo card machine, you can get access to insights and easily accept payments. Our tap-to-pay on iPhone makes contactless payments easier than ever, perfect for businesses who need fast, on-the-go, convenient payments.*

Discover the benefits of integrated payment systems for your business today.

Methodology

Dojo commissioned Censuswide to survey 1,001 SME owners and decision makers in the UK (including microbusiness owners) aged 18+ to find out how businesses manage their finances in 2024. This included asking questions about cash runway, the biggest business challenges, and where businesses borrowed money.

[1] https://www.natwestgroup.com/news-and-insights/news-room/press-releases/enterprise/2023/nov/top-challenges-faced-by-british-business-owners.html

*All payment products require at least one Dojo Go card machine.