How do fraudsters pose as Dojo?

Sometimes fraudsters will pose as service providers like Dojo online to get access to sensitive information. Most of the time, they will use phishing scams to do this.

What’s a phishing scam?

A phishing scam is a fake email that seems real. They’re sent by cyber criminals to encourage people to open malicious links or give away sensitive information like passwords and bank account details.

How can you spot a phishing scam?

Always check the email

Check the company name and sender information by expanding out the sender’s information and subject line.

At Dojo, we’ll only contact you from Dojo with email addresses ending with @dojo.tech, @dojo.co.uk or @mail.dojo.tech.

Emails may be forged to seemingly be sent from Dojo, but with added words like Loans or Finance, or sent via an individual’s personal email address that ends with Gmail or Yahoo. These are red flags.

Always check who you're speaking to

Sometimes fraudsters pose as Dojo over the phone instead of email. If in doubt, say you’ll call them back. If you’re ever unsure, get in touch with us directly via https://dojo.tech/contact/.

Look at the links and website carefully

Don’t click on any links in a suspicious email, and search the company name and website listed in the email separately. If you’re ever unsure, get in touch with us directly via https://dojo.tech/contact/.

Check what you’re being offered

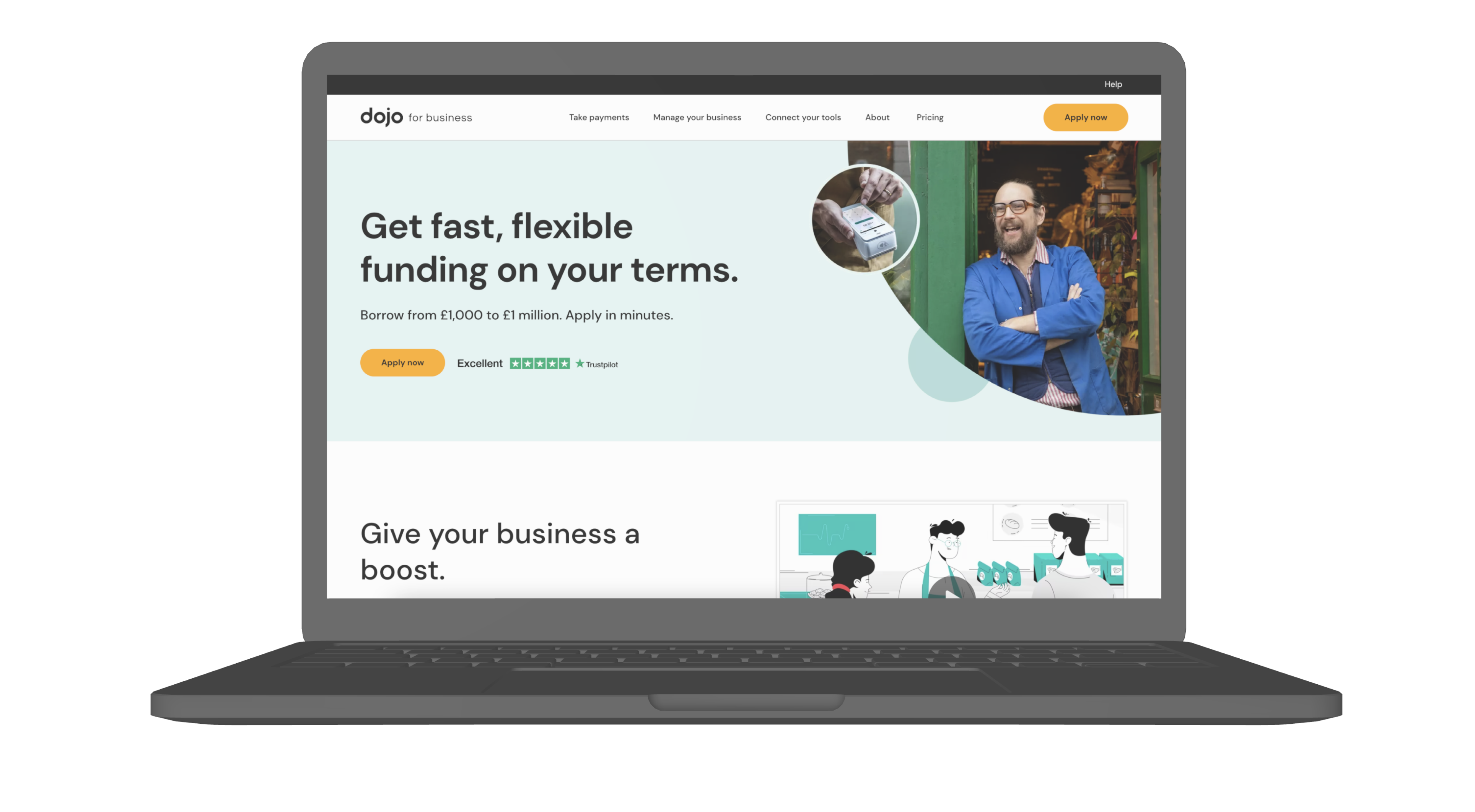

At Dojo, you can find all products and services we offer, and how we refer to them listed on https://dojo.tech/ and https://dojo.app/.

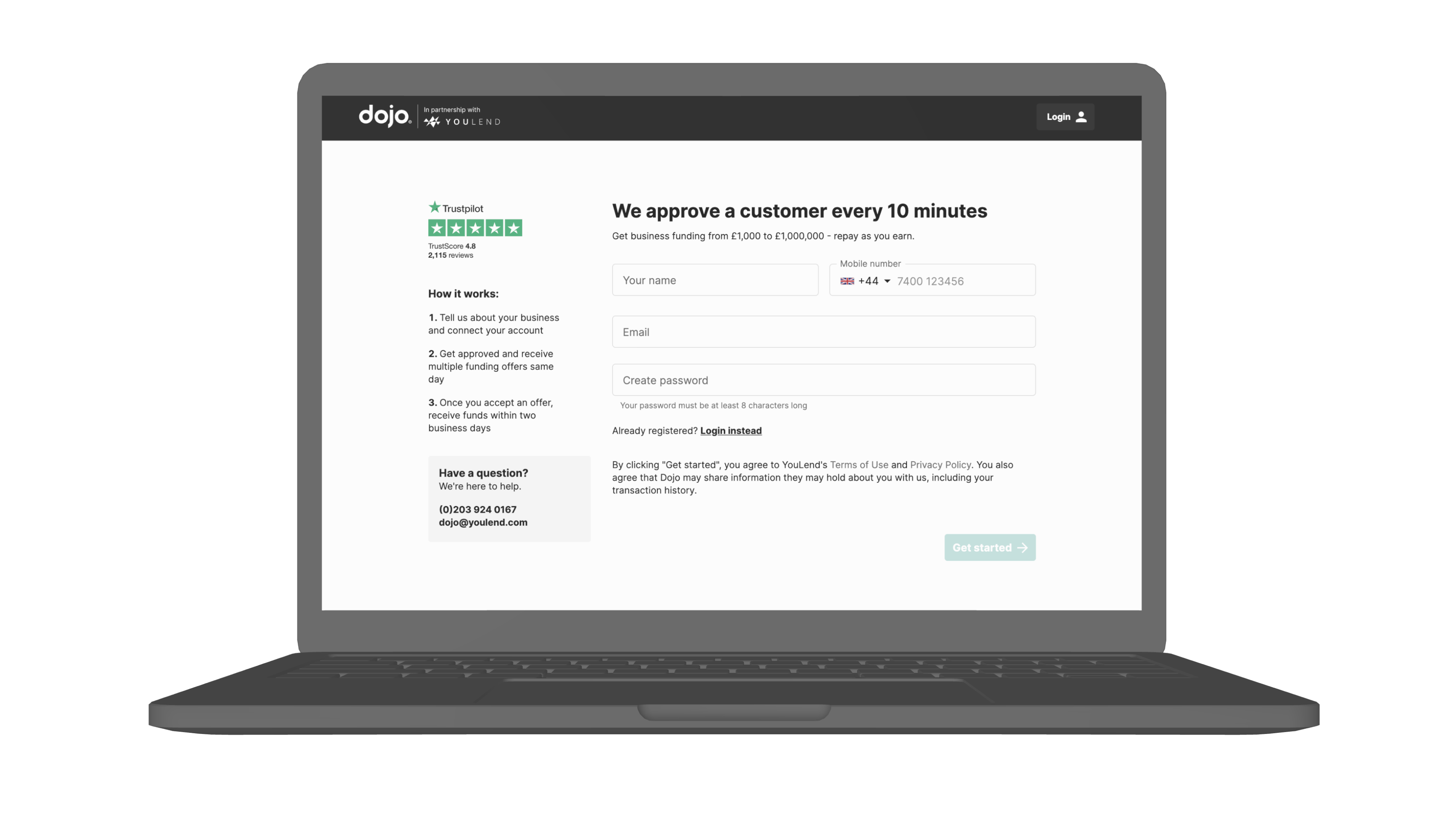

For example, we offer a "business funding” product in partnership with YouLend that only existing Dojo business customers are eligible for and we do not offer non-Dojo customers this kind of funding.

To apply for funding, existing Dojo customers should expect to be directed to a YouLend page from their browser or directly via their Dojo for business app – business funding is always available through an existing Dojo account.

Be careful when giving sensitive information

At Dojo, we’ll never ask you for pre-payment or guarantors for any of our products or services. We’ll also never ask for sensitive information like payment details without running through a few security questions first.

What should you do if you think you’ve been targeted by a phishing scam?

If you think an email you’ve received is a scam or you’ve clicked on a link, change your passwords and forward the email to report@phishing.gov.uk.

If you've shared sensitive details such as bank details or identification documents alert your bank immediately and report this to the Financial Conduct Authority (FCA) and Action Fraud (details below). If this has resulted in financial loss, you should report this directly to Action Fraud. You can also contact CIFAS, a fraud prevention community that enables people to apply for a protective registration so that firms know they may be subject to fraud (details below).

FCA

Website: https://www.fca.org.uk/contact and https://www.fca.org.uk/consumers/loan-fee-fraud

Phone: 0300 500 8082

Action Fraud

Website: https://www.actionfraud.police.uk/

Phone: 0300 123 2040

CIFAS

Website: https://www.cifas.org.uk/contact-us/i-want-help-or-advice-on-scams

What do we do about phishing?

Today, with the cost of living crisis, cyber criminals are increasingly trying to capitalise on online consumer behaviour through scams.

Phishing is incredibly common, with half of UK adults having been sent a phishing message according to a survey by the Office for National Statistics.

Like consumers, businesses also face the threat of phishing scams, and the most common type we see is scammers posing as business service providers.

For our customers, educating staff about the signs of these types of scams and what to do if targeted by them is critical. That’s why we regularly share tips with our customers to ensure they feel empowered with information, and keep our Help Centre populated with the latest fraud prevention tips.