With the rise of digital payments, small businesses in the UK are seeing real benefits in going cashless. Faster transactions, seamless operations, and enhanced security are pushing us toward a cashless society.

What are cashless payments?

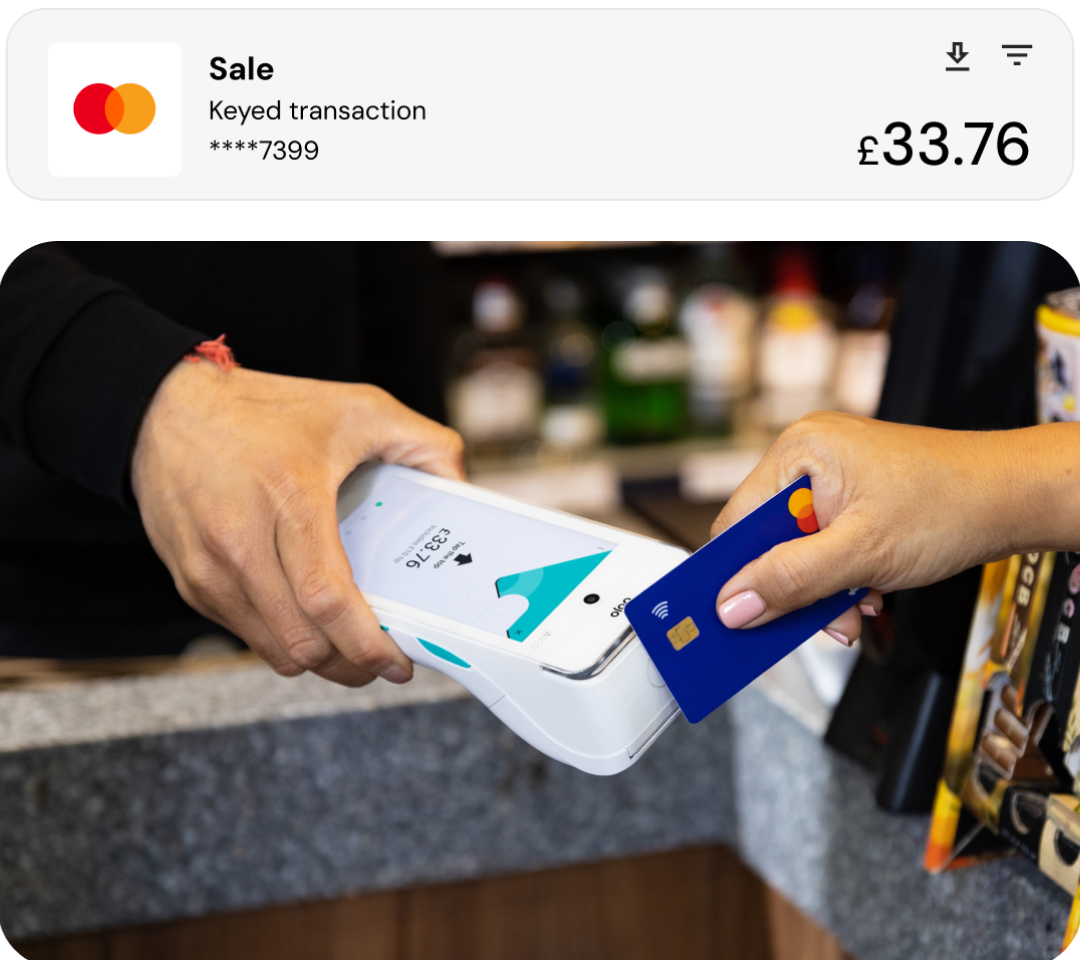

Cashless payments simply mean replacing physical cash for digital transactions, whether online or via an electronic point of sale (EPOS) in stores.

With features like mobile payments that use Near Field Communication (NFC), tap-to-pay cards and digital wallets, paying is now quick and easy – no matter where you are in the world.

So why are small and large businesses alike making the switch to go cashless?

The benefits of going cashless

A speedy checkout

By adopting cashless transactions, businesses can cut out the time-consuming tasks of counting cash, giving change and reconciling cash drawers at the end of the day.

Cashless transactions are almost instant and also cut down customer wait times and queues. This is a game changer for hospitality businesses working during peak hours – preventing the build-up of long queues that could deter potential customers.

Accurate accounting

Since cashless sales are recorded digitally, there's less room for error – making financial management easier and quicker. This also gives business owners the extra time and resources to focus on strategic decisions rather than getting bogged down in daily operations.

With Dojo, integrating payments with various accounting software is seamless, giving you a comprehensive financial overview of your business. You can manage inventory recording and office expenses, all in one place. This lessens the need for separate books or records for ordering and costing.

Real-time transaction data and inventory management help businesses quickly identify which products are selling well and which aren't, allowing for faster restocking decisions and better inventory control. This responsiveness to market demand will help you see greater profitability.

Find out how we helped La Mia Mamma save over 20k a year with our integrated payments.

Customer satisfaction

Customers love the simplicity and security of cashless payments. They enjoy quicker checkouts and the flexibility of using their preferred payment method – from contactless cards to mobile apps.

The data from cashless payments can help businesses offer personalised deals and rewards, boosting customer loyalty. In today's competitive market, making payment easy and secure can really set a small business apart.

More security

Switching to cashless payments reduces the risks associated with handling cash and introduces a layer of protection against fraud and theft. This can include internal mishandling by employees as well as external break-ins as there’s no physical cash to steal.

Cashless transactions also guard against fraud – from external scams to unauthorised charges – by using secure digital trails that are harder to manipulate. These also often come with tools for monitoring transactions in real-time, helping businesses to quickly identify and respond to suspicious activities.

Minimise human errors

Handling money comes with unique challenges, including inaccuracies that can negatively impact both customers and the business. These inaccuracies might involve accidental overcharging or undercharging, errors in giving change, mistakes in recording transactions, and delayed payments.

Plus, digital payments typically process instantly – which means going cashless provides a more accurate, efficient and secure way to handle transactions.

Competitive advantage

UK Finance predicts that by 2028, cash payments in the UK will drop to 3.8 billion, making up just 9% of all transactions. While cash payments will still exist, it’s likely to move further down the list of preferred payment methods.

This trend shows a strong customer preference for cashless payment methods. For small business to thrive and differentiate themselves from competitors, embracing cashless payments is key to providing the convenience and flexibility your customers expect – whether through contactless cards, mobile apps or wearables.

What businesses benefit most from going cashless?

While many different types of businesses can benefit from adopting cashless payment methods, this is particularly true for those in the hospitality sector – such as pubs with beer gardens. These outdoor venues often face challenges with traditional cash transactions, especially during peak times when efficiency becomes especially important.

By choosing portable, 4G-enabled payment machines, hospitality businesses can offer their customers the convenience of paying with just a tap – whether they're ordering from their table or at the bar. This not only streamlines the payment process, making it quicker and more convenient for both staff and customers but also delivers a better customer experience.

So, we now know that going cashless means improving the shopping experience and encouraging customers to come back – speeding up the service as well as easy tracking of sales and customer habits. This is also useful for tailoring services and promotions and boosting overall security. Let's talk about how to make the switch.

How to take cashless payments

1. Assess your needs

Before switching to cashless payments, think about your business needs. Look at the kinds of sales you make and what payment methods your customers like to use. This will help you pick the right card machine, whether it's fixed, portable, or mobile. It also helps you figure out how many machines you need.

2. Open a merchant account

A merchant account at Dojo allows business owners to accept electronic payments. This special account is held with an acquiring bank or merchant acquirer and is necessary for processing card transactions.

3. Choose your electronic point of sale system (EPOS)

An EPOS system uses advanced software to manage inventory, complete sales, collect data and track sales history, modernising your point of sale. With Dojo, we can connect with over 600 types of EPOS systems – so odds are, our card machines will click right into place.

4. Get your equipment

Purchase card machines that will sync seamlessly with your selected EPOS system. With Dojo, you’ll also have access to award-winning customer service and a payments platform to suit your business needs.

5. Start advertising

Inform customers about your new card and mobile payment options through updates on your website and social media. You can also use in-store signs for visibility and offer discounts or rewards as incentives for customers to embrace cashless payments.

If you want your small business to accept card payments, check out what Dojo has to offer. If you’re looking for a mobile payment card machine, check out Dojo Go, which takes payment over 50%* faster than the industry average for the competitive edge.

*In an independent research study with Savanta 2023.