Guide to tax returns for small businesses

Navigate tax returns for small businesses with ease. Our guide covers filing, deadlines, deductions, and compliance – helping UK businesses stay tax-efficient.

As a UK small business or medium-sized enterprise (SME) owner, understanding tax returns can seem daunting. Our guide will walk through the essentials of corporate tax returns, how to file an income tax return for small business, as well as clarify obligations and maximise deductions, covering:

- Who needs to file a tax return?

- Understanding tax returns for companies in the UK

- Key deadlines for small businesses

- Filing company tax returns

- Understanding the CT600 form

- How much tax does a small business pay?

- How to file a small business tax return

- Sample small business tax return

- Maximising tax deductions

- How Dojo can help

- FAQs

What is a tax return for small businesses?

A small business tax return is a report submitted to HMRC detailing a business's financial activity to make sure the correct tax is paid. Businesses in the UK will need to submit tax returns to comply with regulations and access potential deductions.

Keeping detailed financial records throughout the year is key for a smooth tax return process. This includes tracking all income, expenses, and relevant supporting documentation. Good record-keeping simplifies tax preparation and provides important insights into the financial health of the business.

Types of tax returns for small businesses

Different business types have different tax return requirements:

- Sole traders: Income tax return for small business (filed through Self-Assessment).

- Limited companies: Corporation tax returns (using a CT600 form).

- Partnerships: Filing requirements and nominated partner responsibilities.

- VAT returns: Required for businesses with taxable turnover over £90,000.

Who needs to file a tax return?

- Businesses earning above the tax threshold.

- Sole traders and partnerships registered for self-assessment.

- Limited companies that are liable for Corporation Tax.

- VAT-registered businesses (submitting tax returns).

Understanding tax returns for companies in the UK

A tax return for small business includes:

- Company accounts: Overview of business finances.

- Corporation Tax calculations: Taxable profit calculations.

- CT600 form: The official tax return document.

Since taxable profits don’t always match the figures in a company’s accounts, a Corporation Tax computation is used to adjust for allowable expenses, deductions, and other tax rules, to ensure the correct amount is reported to HMRC.

Key deadlines for small businesses:

Here are the main accounting dates to keep track of, including the small business tax return due dates:

- Self-Assessment tax return: 31 January (online filing) – this serves as the income tax return for small business owners operating as sole traders or partnerships.

- Corporation Tax filing: 12 months after the accounting period ends.

- VAT return: Quarterly, 1 month and 7 days after the VAT period ends.

- PAYE and National Insurance: Monthly by the 22nd.

Filing company tax returns

- Submit the CT600 form to HMRC within 12 months of their accounting period ending.

- Pay Corporation Tax within 9 months and 1 day after the period.

- File company accounts with Companies House within 9 months of the period’s end.

Understanding the CT600 form

The CT600 form is a must for limited company tax returns, reporting income, expenses, and tax calculations, filed online via HMRC or compatible software.

The following information will need to be provided for the CT600:

- Company information, including your Unique Taxpayer Reference (UTR).

- Details of your company's income and expenses.

- Calculations of your taxable profits and the amount of corporation tax due.

- Information on any tax reliefs or allowances you're claiming.

It's important to note that the CT600 form is separate from your annual accounts, which will need to be filed with Companies House – the financial information in both should be consistent.

How much tax does a small business pay?

- Sole traders: Income tax rates apply based on earnings.

- Corporation Tax: 25% for profits over £250,000; 19% for profits up to £50,000.

- VAT: Charged at 20% if turnover exceeds £90,000.

- National Insurance: Class 2 and Class 4 contributions apply to sole traders.

- Dividend tax: This applies to company directors taking dividends.

How to file a small business tax return

- Gather company accounts, financial records, receipts, and invoices.

- Choose a filing method via HMRC online, third-party software, or an accountant.

- Calculate taxable profits (adjust total profit for allowable expenses and tax reliefs).

- Complete the CT600 form.

- Prepare supplementary pages (if applicable).

- File accounts with Companies House.

- Submit the necessary files online via HMRC using the Government Gateway ID before the small business tax return deadline to avoid penalties.

- Pay corporation tax by the deadline – typically 12 months after the accounting period ends.

Sample small business tax return

Find a small business tax return example below:

Self-assessment – self-employment (SA103 - sole trader)

Business name: ABC Consulting

Business UTR: 1234567890

Principal business activity: Consulting

Accounting method: Cash basis

Income

- Turnover (gross income): £80,000

- Other income: £0

- Total income: £80,000

Expenses

- Advertising and marketing: £2,000

- Office supplies: £1,500

- Utilities and internet: £1,800

- Business insurance: £1,200

- Legal and professional fees: £3,000

- Travel and meals: £2,500

- Use of home as an office: £3,000

- Other allowable expenses: £2,000

- Total expenses: £17,000

Taxable profit (total income minus total expenses):

- £63,000

Self-employment tax (class 2 and class 4 NICs)

- Class 2 NICs: £179.40

- Class 4 NICs (9% on profits over £12,570): £4,538

- Income tax (20% on profits over £12,570): £10,086

- Total tax due: £14,803.40

How can I reduce my tax bill legally?

Keep clear records

Track all business expenses, including:

- office supplies and equipment

- travel costs

- marketing and advertising expenses

- professional fees (e.g. an accountant or legal fees)

- home office expenses (if applicable).

Understand permissible expenses

For tax for small businesses, it's important to know which expenses are tax-deductible. Typical allowable expenses include:

- vehicle and travel expenses

- salaries and benefits for employees

- rent for business premises

- insurance premiums

- professional development and training costs.

Claim capital allowances

When completing a tax return for a small business, don't forget to claim capital allowances on assets used for business purposes. This can include:

- computers and office equipment

- machinery and tools

- vehicles used

- fixtures and fittings in business premises.

Hiring an accountant

Tax regulations can get complicated and change quickly. Talking with a qualified accountant or accredited tax professional can help maximise deductions and ensure compliance with current tax laws.

Annual Investment Allowance (AIA)

The AIA lets businesses deduct the full cost of qualifying equipment – known as ‘plant and machinery’ – from their taxable profits, up to a set limit. This can significantly cut down taxable profits in the year of purchase.

Use research and development (R&D) tax credits

If a business works within innovative fields, it may be eligible for R&D tax credits. These can provide a hefty tax relief and are often overlooked by small businesses.

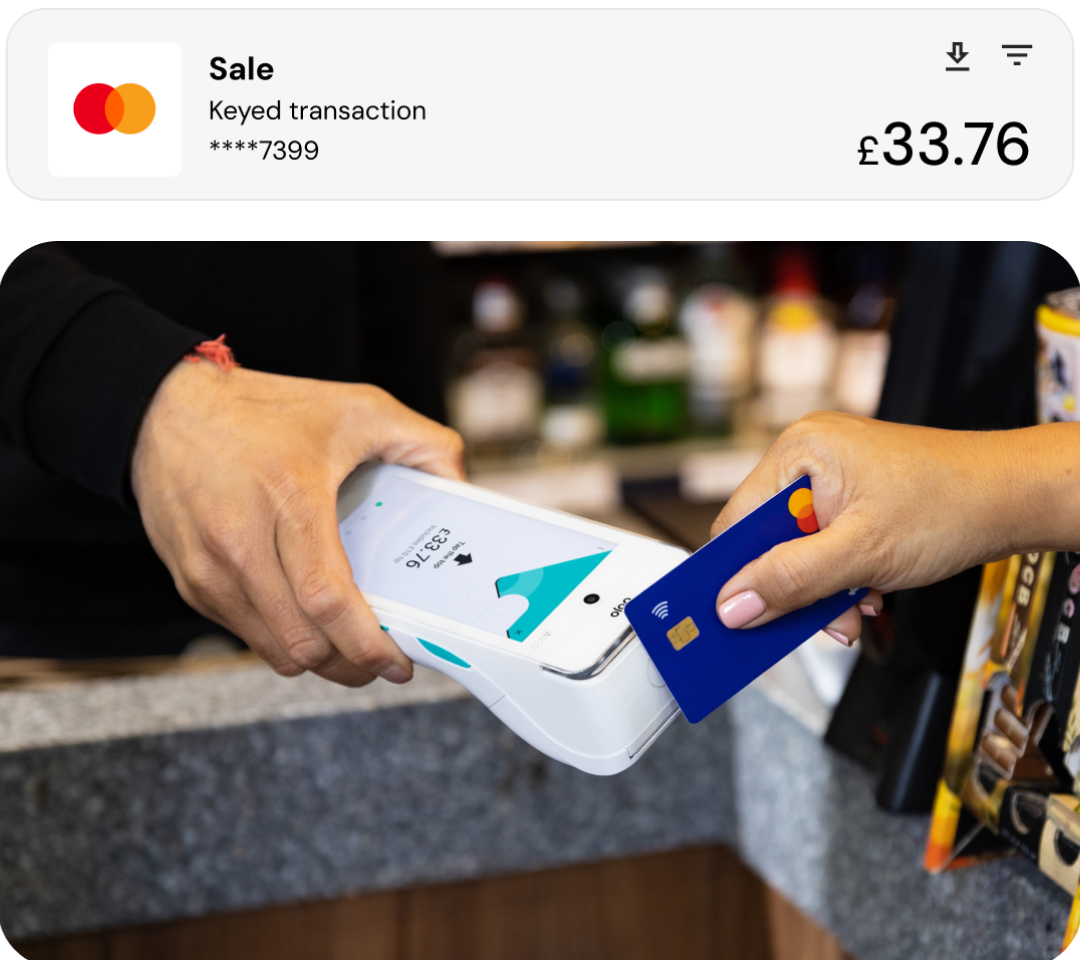

Dojo can help your cash flow

Managing your small business tax return is easier when your payments and records stay organised. With the option of next-day transfers, seamless accounting integrations, and clear transaction tracking, Dojo helps you stay on top of your finances – all year round.

See how our card machines can support your business, whether you’re an SME or enterprise – start accepting card payments today.