In the UK, more than 7.4 million people are already living a cashless life, doubling in the past two years, according to UK Finance.

But, over the past year, the pandemic has changed our spending habits tenfold. Many small businesses across the UK have had to adjust and modify the way they accept payments. Some companies have even opted to only accept card payments and contactless payments.

At Dojo, we were curious to discover which cities across the UK embrace contactless payments the most. To find this out, we analysed both contactless card payments and Apple, Google, and Samsung Pay digital wallet payments across towns and cities in the UK.

We ranked these locations based on the percentage increase in uptake of contactless spending to find the UK's capital of contactless payments.

York sees the biggest contactless spend increase, year on year

Our analysis of the number of contactless card payments in each UK city has revealed that York has seen the most significant UK increase of 11% from the beginning of the pandemic to March 2021.

During the pandemic, social distancing remained a strong rule throughout, which led to 84% of payments in York being made by contactless cards.

Plymouth residents also saw an increase in contactless payments, with 82% of all payments last year being made by contactless cards. The South West city had a year-on-year increase of 11%, placing it at number two on our ranking.

London ranks third, where 85% of shoppers have used contactless card payments throughout 2019-2020, a 10% year-on-year increase.

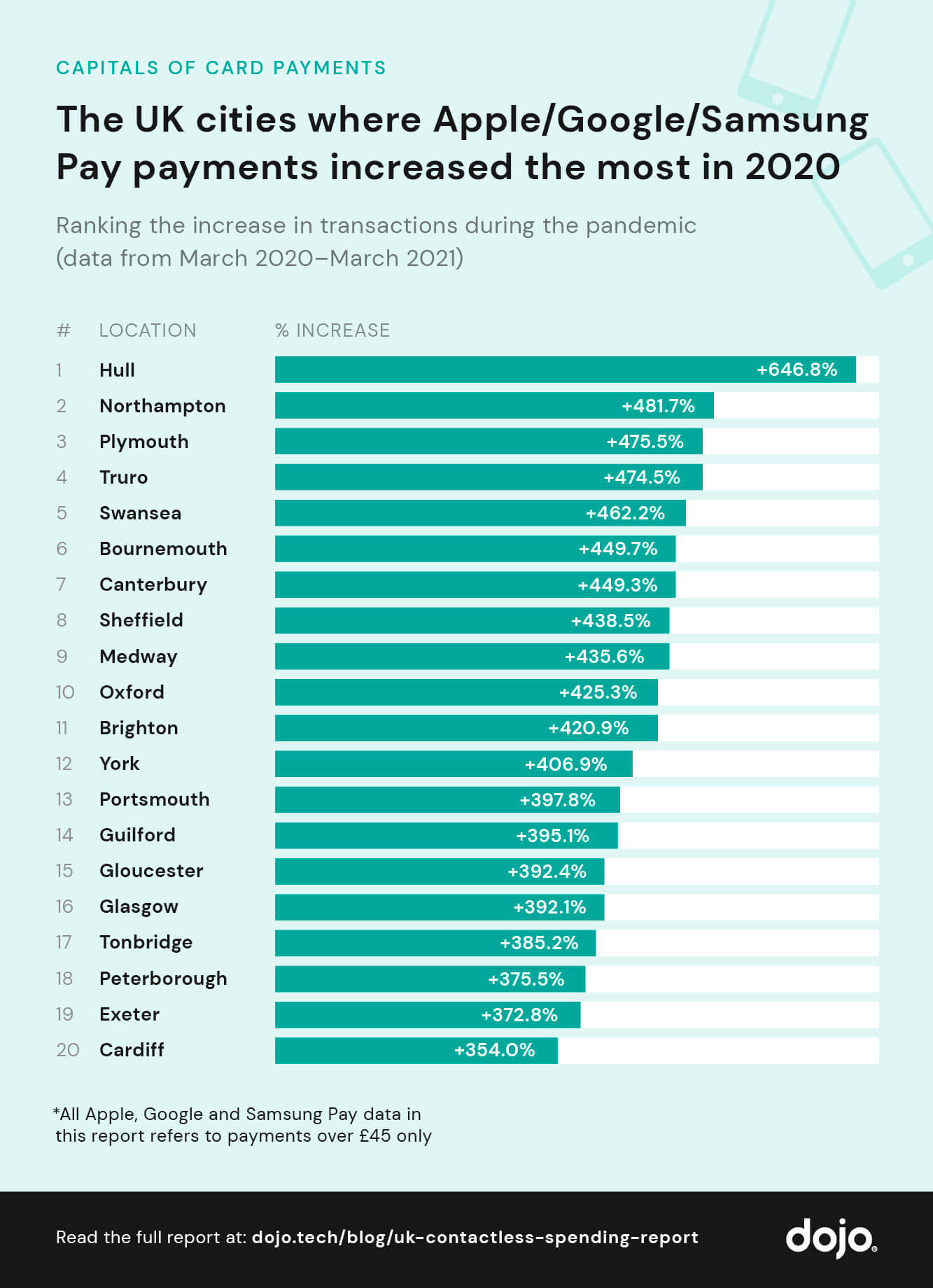

Hull is adopting Apple and Google Pay faster than anywhere else in the UK

Although the UK has seen a massive increase in contactless payments, Hull saw the most significant increase of people paying using Apple and Google Pay since last year for purchases above the £45 contactless card limit.

This increased by a massive 646.8% during the pandemic, which saw 4.67% of all transactions using some form of contactless payment (Apple, Google, and Samsung Pay) in 2020.

In second place is Northampton, with contactless payments increasing by almost 482%. Of all contactless payments made, 6.78% of all transactions were made using Apple, Google, and Samsung Pay.

Plymouth also followed suit as one of the fastest cities in the UK to adopt digital contactless payments, as there was an increase of 475.5% since last year. Between 2020 and 2021, 5.25% of all transactions were made with Apple, Google, and Samsung Pay.

Apple and Google Pay are increasing at a faster rate than contactless card payments

Throughout the pandemic, it's clear that contactless payments are becoming more popular and have only accelerated in 2020.

Although contactless payments by card are the most common way to pay, Apple and Google Pay have increased more rapidly during the pandemic. This is perhaps due to the higher transaction limits they allow consumers.

Customers paying with contactless cards can only pay up to the limit of £45 without being asked for their PIN. This is set to change in the coming months as Rishi Sunak announced the contactless card limit would increase to £100.

The FCA commented: 'Recognising changing behaviour in how people pay, as part of a wider consultation, we will shortly be seeking views on amending our rules to allow for a possible increase in the contactless limit to £100.'

If you're looking to accept contactless safely in your business. Find out how Dojo can get you paid securely, efficiently and on-time. See our range of card machines here or get your quote today.

Methodology

To determine which city has most embraced contactless payment methods, we analysed anonymised card transaction data from our customer base between 2019-2021.

The number of contactless transactions and Apple/Google/Samsung pay transactions from across the UK was also analysed to discover how they have increased over the past twelve months during the COVID-19 pandemic.

Note that all Apple, Google and Samsung Pay contactless data in this report refer to payments over £45 only.